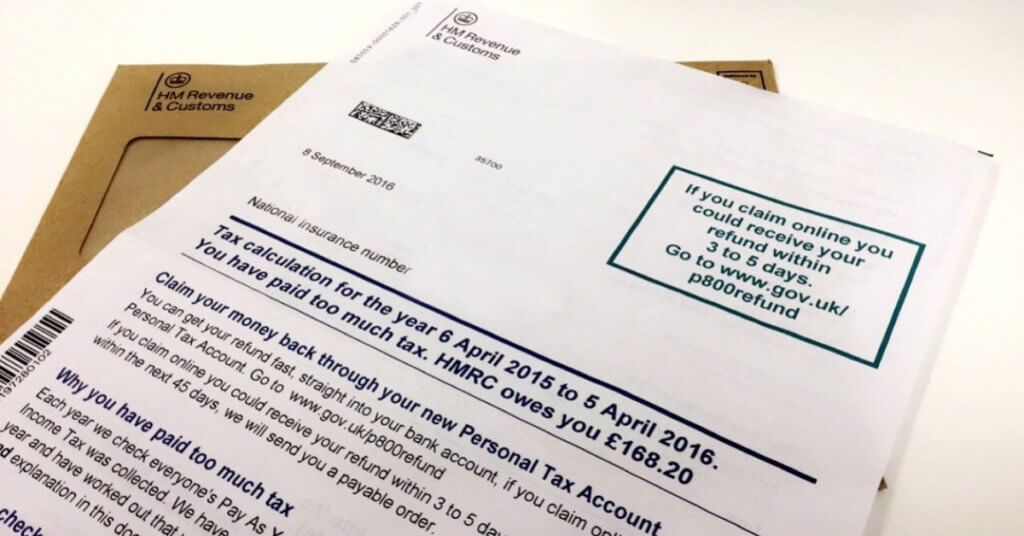

If you’ve received a letter from HMRC advising you that you have paid too much tax, you can now claim your refund online by using your Personal Tax Account.

HMRC’s end of year reconciliation process for PAYE taxpayers started on 10th June 2016 and is expected to result in six million letters being issued to individuals who have not paid the right amount of tax. The letters, officially called P800 Tax Calculations, will go out between August and October.

What has changed this year?

Previously, if you received a P800 tax calculation which showed a refund was due, you could expect to receive a cheque through the post a few days later. For 2016, as HMRC continues its “digital strategy”, taxpayers are encouraged to claim their refund online using their Personal Tax Account and have the money paid directly into their bank account.

Check your calculation

If you receive a P800 calculation, it is important to check the income and tax figures carefully against any P60, P45 and P11D certificates you have for the year – the calculations are only as good as the information held by HMRC, which is by no means perfect! Remember, HMRC state that it is your responsibility to spot any errors!

Tip: 3 ways to increase your refund!

Your P800 calculation will not automatically include all of the tax reliefs that may be available to you – HMRC expects you to make a separate claim for these. Here are 3 allowances that could bump up your refund by £1000’s!

- Uniform laundry allowance – If you wear a uniform to work which contains your company logo, you can claim extra tax back to cover the laundry costs.

- Professional fees and subscriptions – If you pay fees to certain professional or regulatory bodies (e.g. RCN, NMC etc), you may be able to claim tax back on your annual fees. This also applies to SIA licence fees.

- Mileage allowance – if you meet the criteria, you may be able to claim up to 45p per mile if you need to use your own car for work. The rules are quite complex so do contact us for professional advice if you want to claim this.

How to claim your refund

If you’re one of the “lucky” ones who overpaid tax last year and you’re happy that the calculations are correct, you have 3 options to claim your refund:

Option 1: Head over to the official HMRC website and follow the steps to request a refund through your Personal Tax Account. To claim online, you will need to sign in using your Government Gateway ID. If you’ve never used HMRC’s online services, you’ll be prompted to set up a Government Gateway ID. Make sure you have the following information to hand

- Your national insurance number.

- P60 for 2015/16, a payslip or your passport to verify your identity.

- Your employer’s PAYE reference number (you can find this on your P60 or P45).

- Access to a landline or mobile (you will be sent a verification code when registering).

- Your bank account details.

Once you’ve completed the online process, the rebate should be in your bank account within 3-5 days.

Option 2: If you’re having trouble accessing your online account, you can contact HMRC on 0300 200 3300 to request your refund (warning: expect long waiting times on the phone!).

Option 3: Wait for a cheque. If you don’t claim your refund online within 45 days, HMRC will automatically send you a cheque for the full refund.

Is “www.gov.uk/p800refund” a genuine website?

Yes, www.gov.uk/p800refund is the new link HMRC use to direct you to the correct page for claiming back overpaid tax.

There are a lot of scams going around relating tax refunds. It is important that you remain vigilant online and never disclose your personal details unless you are sure the website is genuine. HMRC never send out emails or text messages telling you about a refund.

How to get help

You can contact HMRC on 0300 200 3300 or leave a comment below and we’ll do our best to help you out!

I am unable to make a claim online for p800 tax rebate

Hi Ranjana, a lot of people are having trouble claiming online. I would suggest either calling HMRC on 0300 200 3300 or waiting 45 days for them to send you a cheque.

Seems a lengthy process to claim rebate on line so have decided to wait the 45 days. Might have felt differently if it was a larger amount.

Yep, that seems to be the general consensus! Before you would just receive a cheque in a few days, now you have to wait 45 days if you can’t do it online!

agreeing with Gillian- a big faff to get money owed to US ! not easy at all, disappointed again.

Agreed, we’ve spoken to literally hundreds of clients over the last week and the feedback is all bad! We really cannot see the point in this change.

I wish to claim my rebate, recieved a letter from you but not finding it easy to get on the right web site

The correct website is https://www.gov.uk/check-income-tax-last-year

As usual they tell me to easily get my refund online but like all the others its too much trouble.

Why didnt they just send the cheque with the refund letter!!!! too easy,

I received a letter from yourselves this morning telling me i have overpaid tax and i am due a refund,Which goes on to direct me to this site,

Unfortunately this site is like a merry go round at the fair,it just goes round and round i circles.I am just getting nowhere,

Why don,t the HMRC just send a cheque like they used to do,So much easier.

Hi George,

I’m afraid you are mistaken. We are an accountancy firm who have put together this article for people struggling to find out how to claim their repayment. HMRC most certainly do not direct you to our website!! Nowhere does it say we are HMRC nor is the website or url even remotely similar!

The link you are looking for is mentioned 3 times in this article but here it is again https://www.gov.uk/check-income-tax-last-year

WHAT A PILE OF POO this is i was told 10 mins max and I would be done 20 MINS LATER AND I am still sitting here with nothing and none the wiser giving up now will try again later when less frustrated or they could just send the cheque now 🙁

THIS AS USUAL WITH THE TAX OWED TO PEOPLE IS A VERY FRUSTRATING PROCESS WHY ARE YOU KEEPING US WAITING 45 DAYS ? OH YES TO GET MORE INTEREST IN YOUR COFFERS WHAT A SWIZ

Can’t access p800refund site. more merry go rounds than a fair

Agree totally with all the comments above! Am going to give it ONE last try online and then….well, I just have to wait for 45 days….I guess it will be just in time for Xmas! As for the ‘helpline’…I’m afraid my alloted lifespan is not that long! Just in case any HMRC employee’s are reading this ‘rant’, I’m not having a personal dig at you guys! I would guess that there are less and less of you doing more and more work. It’s just that I have a rather rapacious Landlord…..

PS: And when I pay THEM what’s left over will be spent on books!

I found this whole process, very easy. Took 5 minutes online and money due in my account anytime now. Not sure what you people are up to.

Russell can I apply for the refund on behalf of my husband as he is not computer literate. Is it difficult to do.

Hi Russel, we did my husbands on Friday online, very easy took couple of minutes, did it take long for your refund? it said 3-5 working days once we completed it.

Thanks

Russell how long did it take for your money to come into your account? I’ve been waiting over a week and no sign.

I am living and working abroad now and have recently receive a letter concerning my refund from HMRC. It is difficult to deal with this matter being outside of the UK, could you please advise me urgently how best it is to deal and recover my refund.

Don’t know how to claim on line

I have entered the wrong details on the verify page too many times , will I be able to try again soon or will I be forever blocked ?

I have recently received a letter concerning my refund from HMRC. It is difficult to deal with this matter being outside of the UK, could you please advise me urgently how best it is to deal and recover my refund

How do I go about claiming my overpaid tax back

Being waiting 45 days for my refund and still have not received it.

Hi Patrica, you can contact HMRC on 0300 200 3300.

Like so many others, I find it time wasting & frustrating to find the correct “form ” on which to claim my refund. I give up and will,reluctantly, wait the 45 days.

I followed the instructions online and voila 3 days later my refund was in my bank account…simples!!

Hello there Sanjay,

Thanks for the article. Very good and informative.

I went online and claimed my rebate. Nice surprise that the online process was quick and super-smooth. All done and now waiting. It said 3-5 days. Is this days or working days as I did this on Saturday morning. 29th October. Hoping to see the money in my bank account. Thursday or Friday 3rd/4th November. Or am I being too optimistic. Thanks.

O preferred it better when they sent u the cheque with the letter not go through all this online rubbish x

I agree with i George its easier the old way some people haven’t got computers or the internet on there Mobile’s x

Unable to complete claim online as p60 does not have the information I need to fill it in, pointless sending this letter out in the first place , will just have to wait 45 days. Is this done on purpose?

Been online to hmrc about my tax refund still waiting for my money when we owe them money they take it stright away but when they owe us it takes them a long time to sort it out come on i need this money asap

is the waiting 45 days for the cheque start from when my p800 was posted

I have been waiting 8days now and counting,how long does it take for the letter to come. It was issued on 1st November.

Managed to do my tax return easily online. However it said money should be in my account in 3-5 days and it’s been over a week now and nothing. How long did it take anyone else who did it online?

I received my letter on 20th of September and still have no cheque how long does the cheque take to come ??

Filled out via email last Wednesday…still waiting

HMRC what a load of rubbish even going by their rules on screen it is impossible to get on line. am now on phone. Doesn’t seem to understand what I am saying.

What a surprise,

This country is doing to the dogs, !!!!!!!!

Unable to claim rebate on line due to lack of mobile signal at this location yet another example of ripoff Britain starts at the top.

So how did you post this message?

I have just received my Annual Tax Summary 2015-2016. It includes £1060 Marriage Allowance.

Can I claim for a previous year?

Yes it can be backdated.

I received a letter from you saying that I am owed a refund of 56.13 the letter was sent on the 7 November and have not received a check in the post can you help

Hi Malcolm, the letter wasn’t from us. We’re not HMRC.