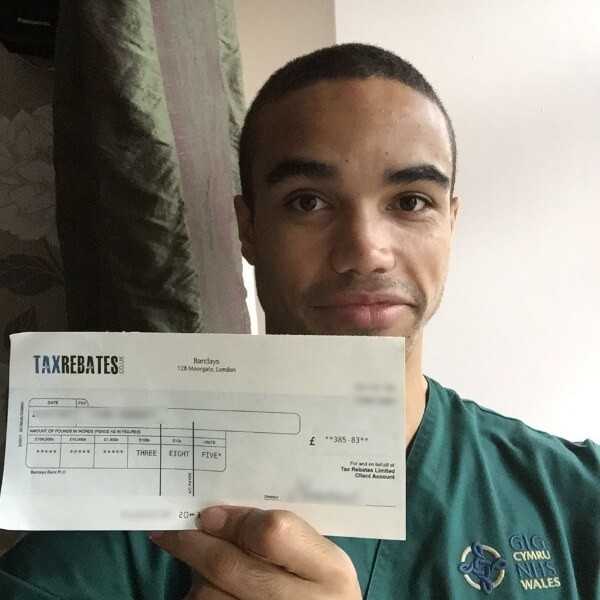

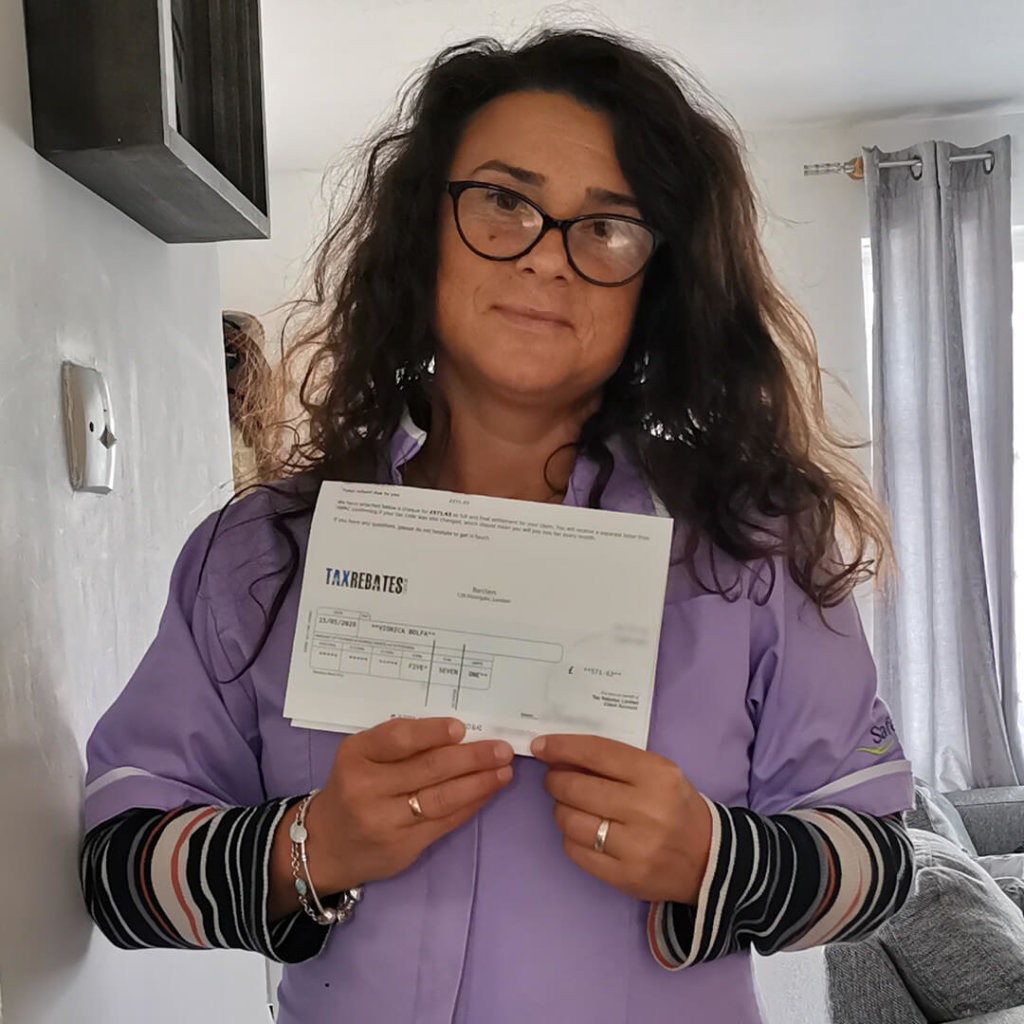

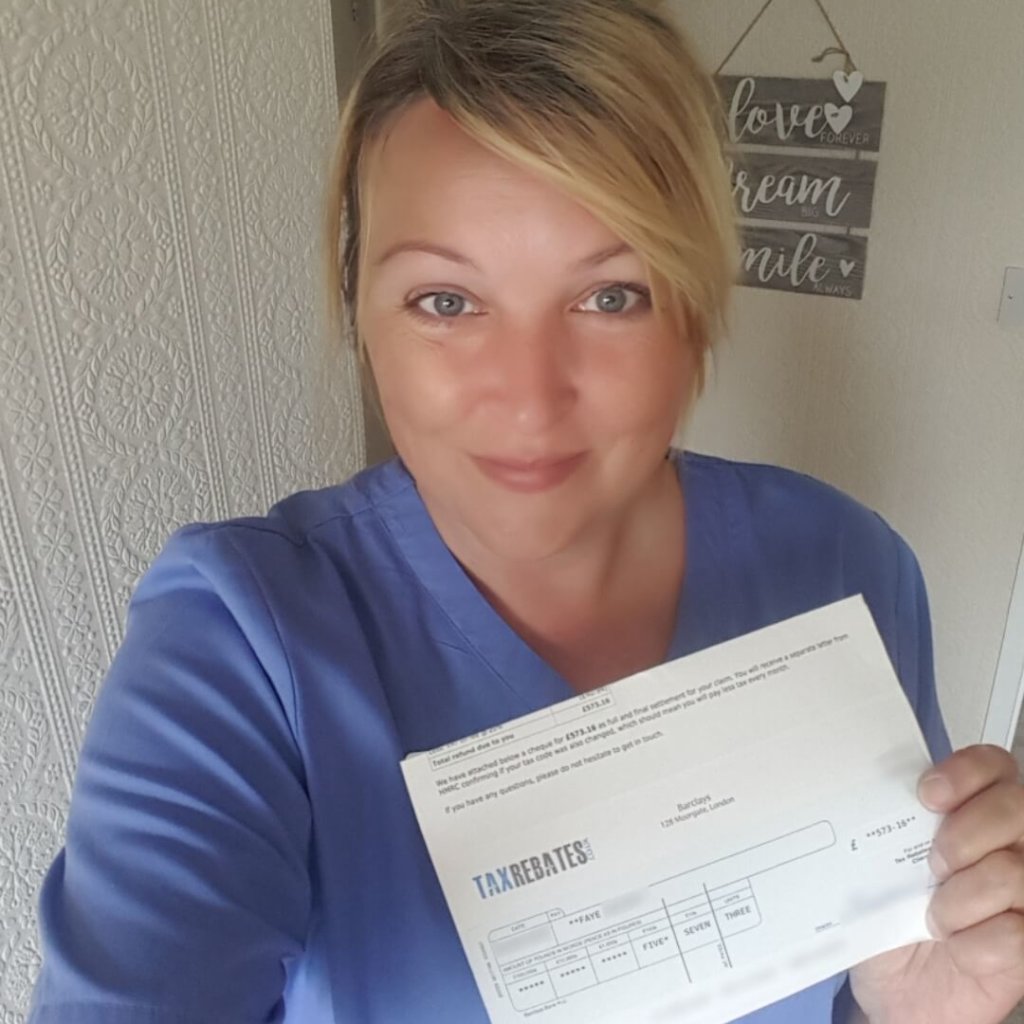

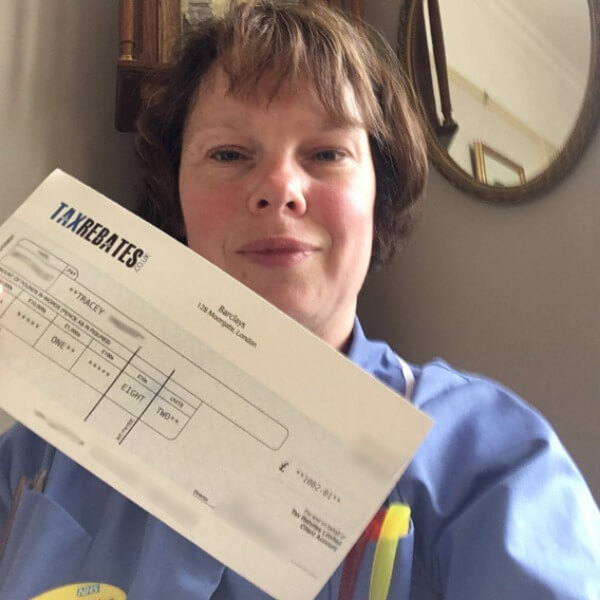

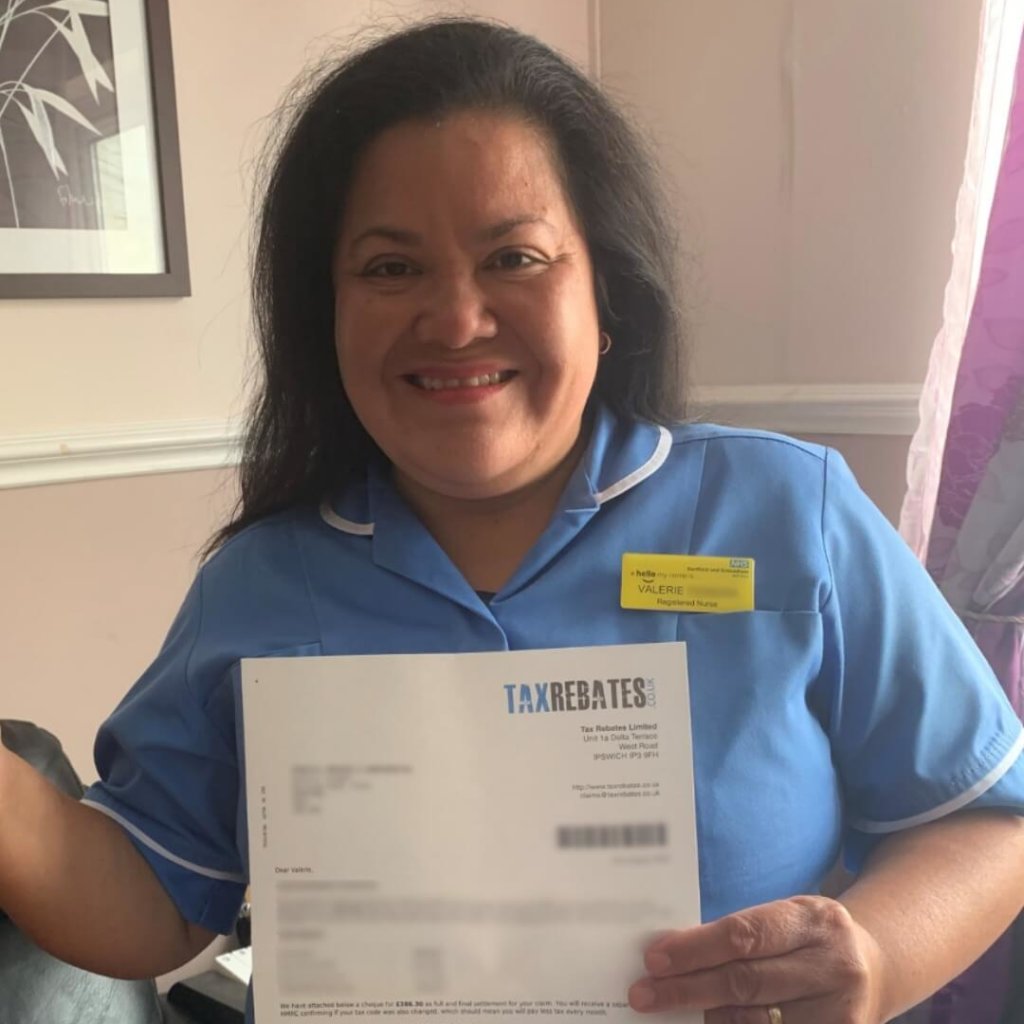

Nurses, midwives and other healthcare workers are amongst a rare group of employees who are eligible to claim extra tax relief for certain expenses they incur as part of their job. Over the years, this tax relief can add up to hundreds of pounds and can only be reclaimed by submitting a claim to HMRC.

Our “no win, no fee” tax rebate service makes it quick and easy for you to make a claim for your tax refund. Complete our 2-minute application form and we’ll take care of the rest! We can backdate your claim for the last 4 years and even apply to change your tax code so you pay less tax every month.

Uniform Cleaning Allowance

If you wear a uniform to work and your employer provides no laundry facilities, you can claim a tax allowance every year for the cost of cleaning your uniform. The amount you can claim depends on your occupation – the table below lists the allowances for some occupations. Use our tax rebate calculator and select your job to see the refund you can claim.

| Occupation | Allowance |

|---|---|

| Ambulance staff on active service | £140 |

| Nurses, midwives, dental nurses, therapists, healthcare assistants | £125 |

| Plaster room orderlies, hospital porters, ward clerks, sterile supply workers, hospital domestics and hospital catering staff | £100 |

| Laboratory staff, pharmacists and pharmacy assistants | £60 |

| Uniformed ancillary staff: maintenance workers, grounds staff, drivers, parking attendants and security guards, receptionists and other uniformed staff | £60 |

As this is a flat rate allowance, you don’t need to provide receipts or any proof of the actual cost of cleaning your uniform.

Professional fees and subscriptions

If you pay fees to professional bodies or unions such as Unison, RCN, NMC, HCPC or SSSC, or if you pay professional indemnity insurance (eg to Medical Protection Society) you can claim tax relief every year on these costs. HMRC will usually allow you to claim 20% of the cost of these expenses.

Mileage Allowance Relief

If you use your own car for work, you may be able to claim an additional tax rebate for mileage. You can claim up to 45p per mile for each business journey you make – for example, you may be a domestic nurse who visits patients in their own home. If you receive less than 45p per mile from your employer, you can claim tax relief on the difference from HMRC.

Shoes and stockings/tights allowance

You can claim an allowance of £12 per year if you are required to wear special types of shoes (eg non-slip) in the workplace. If you are required to wear stockings/tights (or socks for men) of a particular color, then you can claim additional tax relief of £6 per year.