Mechanic Tax Rebate

Are you a mechanic who buys your own tools? You could get some of that money back with a mechanic tax rebate.

Filling out forms and understanding all the rules can be tricky. That’s why we’re here to help. Our team makes it easy for you to get back the money you’re owed.

So why wait? Start your claim with us today and put some of that hard-earned cash back in your pocket!

Am I eligible to claim?

Whilst each claim is assessed on its own merits, you must meet the following basic requirements:

- You pay tax on your wages through PAYE.

- You are required to buy your own tools in order to do your job.

- Your employer does not reimburse you for the tools.

In some instances, we may also ask for a declaration from your manager confirming that you buy your own tools (we’ll provide the template for them to sign). We normally only ask for this if HMRC has rejected your claim and we are preparing an appeal.

How much could I get back?

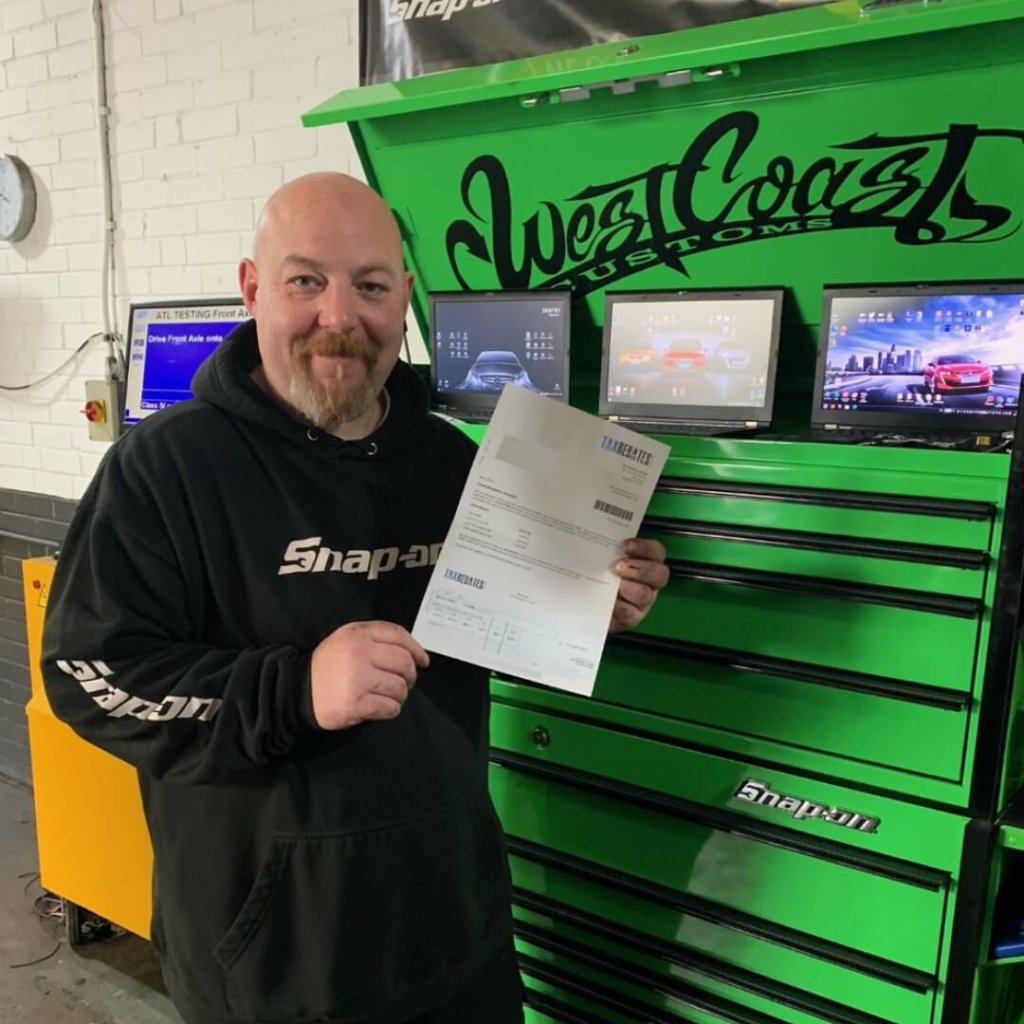

At the moment, the amount that you can claim back on tools stands at around 20% of the initial purchase value including VAT. So, if you’ve spent £2000 on a shiny new high-end toolbox, then you can expect to receive £400 back as a tool tax rebate. Not too shabby, is it?

Example

Jamie has been a mechanic at a fast-fit centre for 4 years. During this time, he has spent £3600 on hand tools and £1100 on a tool box. By making a Capital Allowance claim on his tools, Jamie can expect to receive a tax rebate of around £988.

The actual amount will depend on several factors, including the date of purchase as well as how much tax you have paid through your wages.

Can I backdate my rebate on tools if I haven’t already claimed?

This is the best bit. If you’ve never claimed for a tools tax rebate, we can also backdate your claim to make sure that you receive everything that you are legally entitled to. As long as you can produce the receipts we can help you get the amount you’re owed easily.

What types of tool allowances are available?

The government has set a ‘Flat Rate Expense’ allowance £120 for tools for those in the mechanics and auto-technician trade, but don’t worry if you’ve spent over this amount because there is another way we can help you get the tool tax rebate you deserve.

The Capital Allowance option means that claims over and above £120 are handled a little differently, but you can still claim around 20% of the amount back which can certainly start to add up if you’ve been buying a fair few tools.

That sounds tricky, is there a lot of paperwork to fill out?

Filling in the appropriate forms and understanding mind-boggling Capital Allowance legislation for a tool tax rebate can be time-consuming, so if you’d rather be spending your time doing something other than paperwork, then you can trust the team at TaxRebates.co.uk to do all the hard work for you.

We’re experts in helping mechanics get the tool tax rebate they’re entitled to, so get in touch with us today to discover just how easy it is to get what you’re owed on your tools with minimal effort needed. You can even submit your claim online from the comfort of your sofa! How easy is that?

Is there a deadline for submitting a mechanic tax rebate claim?

Technically, there is no time limit for claiming a mechanic tax rebate on your tools. However, it is recommended that you submit your claim within four years of the end of the tax year in which you purchased the tools. This allows you to receive your full allowance more quickly. If you are claiming for purchases made more than four years ago, you may need to spread the allowance out over several years.

Can I get an idea of how much I could get back on my tool tax rebate before I start the process?

Yes, you can. Our tool tax rebate calculator can give you a good idea of how much you might expect to receive by filling in a few basic details online, so click here to get started. Our calculator only takes a few minutes to fill in; grab yourself a cuppa and see how much you could be set to receive.

When am I not eligible for a tool tax rebate?

If your employer has reimbursed you for the cost of the tools, d you won’t be able to claim any rebate on these items as it’s your employer who’s footed the bill for the items – even if you paid for them first and they gave you the money back at a later date.

Also, if you haven’t earned enough to pay income tax yet, you won’t be able to take advantage of the tool tax rebate (this mainly applies to Apprentices). Keep your receipts safe though, as you will be eligible to make a claim once you have paid tax for a full tax year.

Is there anything else I could claim for?

In addition to claiming for your tools, you may also be able to claim a small uniform laundry allowance if you are required to wash your overalls / protective clothing at your own expense (i.e at home).

What do I need to do to start my claim?

That’s easy! Just click here to do a quick calculation on the amount you could be entitled to and submit your claim, and we’ll do the rest! As tax industry experts, we’ve helped thousands of UK employees in a wide range of industries access the rebates they’re entitled to, so get the ball rolling today, and you could be enjoying your rebate sooner than you think!