What is a P60?

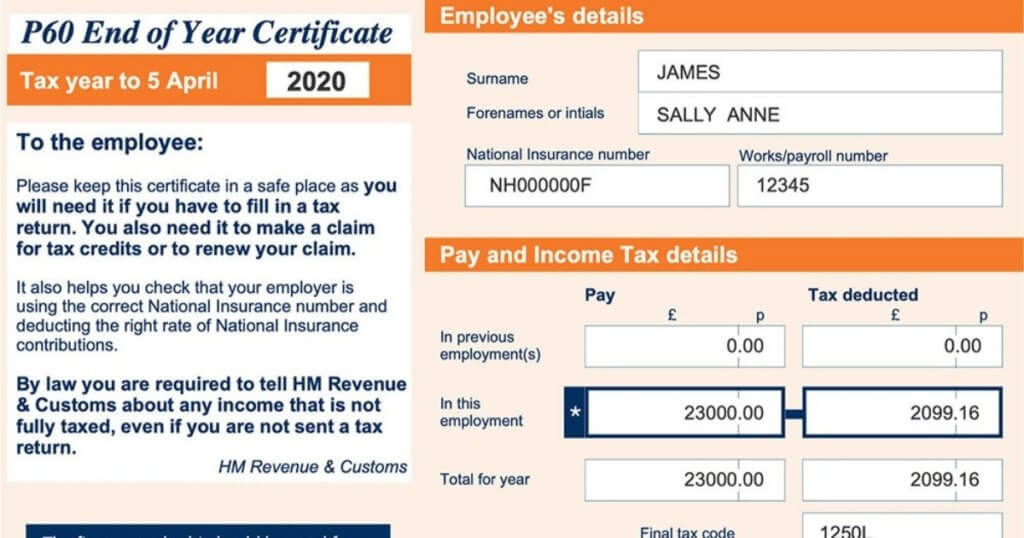

A P60 End of Year Certificate is a document issued by your employer which shows your total taxable salary and income tax for the tax year (a tax year runs from 6 April to 5 April the following year).

The form will also include details of your National Insurance contributions, student loan deductions and statutory payments received for the year.

Whilst the P60 form will show the details of the employer issuing the form, it may also include details of income and tax from previous jobs held in the same tax year

When should I receive my P60?

Your employer is required to issue you with your P60, either on paper or electronically, by 31st May following the end of the tax year.

You should receive your P60 for 2022/23 by 31st May 2023

If you left your employment before 5th April, you will not receive a P60. Instead, your employer will provide you with a P45 shortly after leaving.

If you have more than one job on 5th April, you will receive a P60 from each employer.

Why you might need your P60

Your P60 is an important document – keep it in a safe place! You may need the details from your P60 to:

- Complete your tax return;

- Claim back overpaid tax;

- Apply for tax credits; and

- Apply for a loan, mortgage, or any other type of finance.

How to get a replacement P60

If you need a copy of your P60, we’ve listed a few tried and tested methods for getting a replacement. Explore each option in the order shown.

Option 1: Request a Duplicate Copy from your employer

Sounds obvious, but your employer should be your first port of call. Most companies now use electronic payroll systems that allow duplicate copies of the P60 to be printed/emailed quite easily.

Your employer is not under any legal obligation to give you a replacement, so remember to ask nicely!

Option 2: Request a Statement of Earnings

If your employer is unable to issue you with replacement P60 (e.g. if their payroll software does not have the functionality), you can ask for a Statement of Earnings.

A Statement of Earnings is a letter from the employer on letter headed paper showing income and tax details for the relevant tax year.

See an example of a Statement of Earnings here

Option 3: Call HMRC

You cannot get a copy of your P60 or P45 from HMRC. However, you can request your income and PAYE details. They will almost always have a record of the information contained in the P60s and P45s your employer(s) have filed with them. They will be able to send you a letter confirming your pay and tax for all jobs held during a particular year.

Option 4: Subject Access Request

OK, so you’ve asked nicely and the employer is not playing ball? Here’s an almost sure-fire way to get the information you need!

All employers need to keep details of your pay and tax for 3 years following the end of the tax year. Under the Data Protection Act you can make a request to any organisation which holds your personal data – and this includes your employer! They must respond to your request within 40 days.

You can find out how to make a Subject Access request on the ICO website or simply use our free template letter. Download our free template letter and change the items highlighted in yellow.

We recommend sending the request via email or recorded delivery.

You should note that your employer can legally charge you £10 for this. You can find further details on Subject Access request here, including what do if your employer doesn’t respond.

I have lost my p45 how do I get a copy

The above guide applies to P45 too.